How Much Do Relief Vets Cost? A Breakdown for Practice Owners

Updated: February 2026

You can almost picture it: the end-of-month report blinking on your screen, payroll creeping up, another associate out on leave, and three open shifts you still haven’t filled. You sigh, open a relief platform, and pause at the rates.

“$1,500 for a single Saturday shift?”

If you’ve ever wondered what goes into that number, you’re not alone. Some listings quote hourly rates, others use day rates, ask for production percentages, or add-on fees. And somehow, by the time the invoices roll in, the total rarely matches what you expected.

Relief rates aren’t random. They reflect real factors like demand, workload, and the costs of flexibility. But understanding where those numbers come from is the key to managing them. Because when you understand the economics of relief work, you stop reacting to staffing gaps and start planning for them.

Relief Vet Rates 101

| Model | How It Works | Pros | Cons |

| Hourly rate | Paid for each hour worked—typically $70–$120/hr for small-animal general practice. | Transparent; flexible for partial shifts. | Overtime and record-keeping can add admin friction. |

| Daily rate | Flat rate per shift, often $500–$900/day for GP, $900–$1,400 for ER. | Simple budgeting; covers prep and wrap-up time. | Can obscure true hourly cost on shorter days. |

| Production-based | Relief vet earns a set % (20–28%) of revenue generated. | Aligns pay with performance. | Riskier at clinics with inconsistent caseloads. |

| Hybrid | Base daily + small production bonus. | Balances predictability and motivation. | Requires more tracking. |

Sources: ZipRecruiter, Indeed, VHMA 2023 Survey, community insights from r/Veterinary and r/veterinaryprofession

Rates follow supply and demand more than zip codes on a map.

- High-density urban areas (think Los Angeles, Toronto, New York) push toward the upper end—sometimes $120+/hr.

- Mid-size markets land near the mean: $80–$100/hr.

- Rural clinics often attract talent with housing stipends, travel reimbursement, or flexible scheduling instead of higher rates.

Specialty or ER shifts can double those figures. Weekend, overnight, and holiday coverage command 1.25–1.5× multipliers—sometimes higher when demand spikes.

💡 Want to see how these figures translate to take-home pay?

Check out our companion post,

How Much Do Relief Vets Really Make?

— it breaks down earnings after taxes, expenses, and regional factors.

What’s Included

Relief rates typically include professional fees, self-employment taxes, insurance, and continuing education costs that a full-time associate would otherwise have covered by the clinic.

They don’t include travel, lodging, or platform service fees—details that often catch practice owners by surprise.

In short, relief coverage is a premium for flexibility and risk-sharing. Understanding these building blocks is the first step toward managing costs strategically.

Find Relief Vets on Your Terms

Set the rate, pick the vet, and keep your clinic running at full speed.

The Hidden Costs

Most practice owners assume relief costs stop at the rate on the invoice.

But if you’ve ever scrambled to fill a shift at the last minute, you know that’s not quite the case. The true cost of relief coverage often hides in plain sight — buried in admin hours, disruptions, and lost production.

Let’s unpack the quiet budget drainers.

1. Administrative Time

Relief coverage isn’t plug-and-play. It takes time to vet credentials, negotiate rates, handle contracts, issue payments, and track shifts. If your manager spends even two hours coordinating each relief booking, that’s time (and salary) you’re paying twice: once to your staff, and once to the relief vet.

Multiply that by a dozen shifts a month, and you’re looking at hundreds, sometimes thousands, of dollars in invisible admin labor.

2. Recruiter or Agency Markups

Traditional staffing agencies often add 20–40% on top of a vet’s base rate to cover overhead, liability, and profit.

That means your $800 relief shift could easily cost $1,000–$1,200 after fees.

Modern platforms that connect clinics directly with vets are helping close that gap, but transparency still matters.

3. Missed Production and Onboarding Delays

Even a great relief vet needs time to learn your system, team flow, and preferred protocols. For the first shift or two, productivity can dip by 10–15%, especially if your software or workflow differs from what they’re used to.

That lost output isn’t a failure—it’s the price of short-term help. But it still matters when calculating cost per case or daily revenue targets.

4. Cancellations, No-Shows, and Replacements

If a relief vet cancels last-minute or a shift goes unfilled, the ripple effect can hit hard: rescheduled appointments, overtime for remaining staff, and frustrated clients.

Having backup coverage (or a reliable platform that manages it for you) can turn that unpredictability from chaos into contingency.

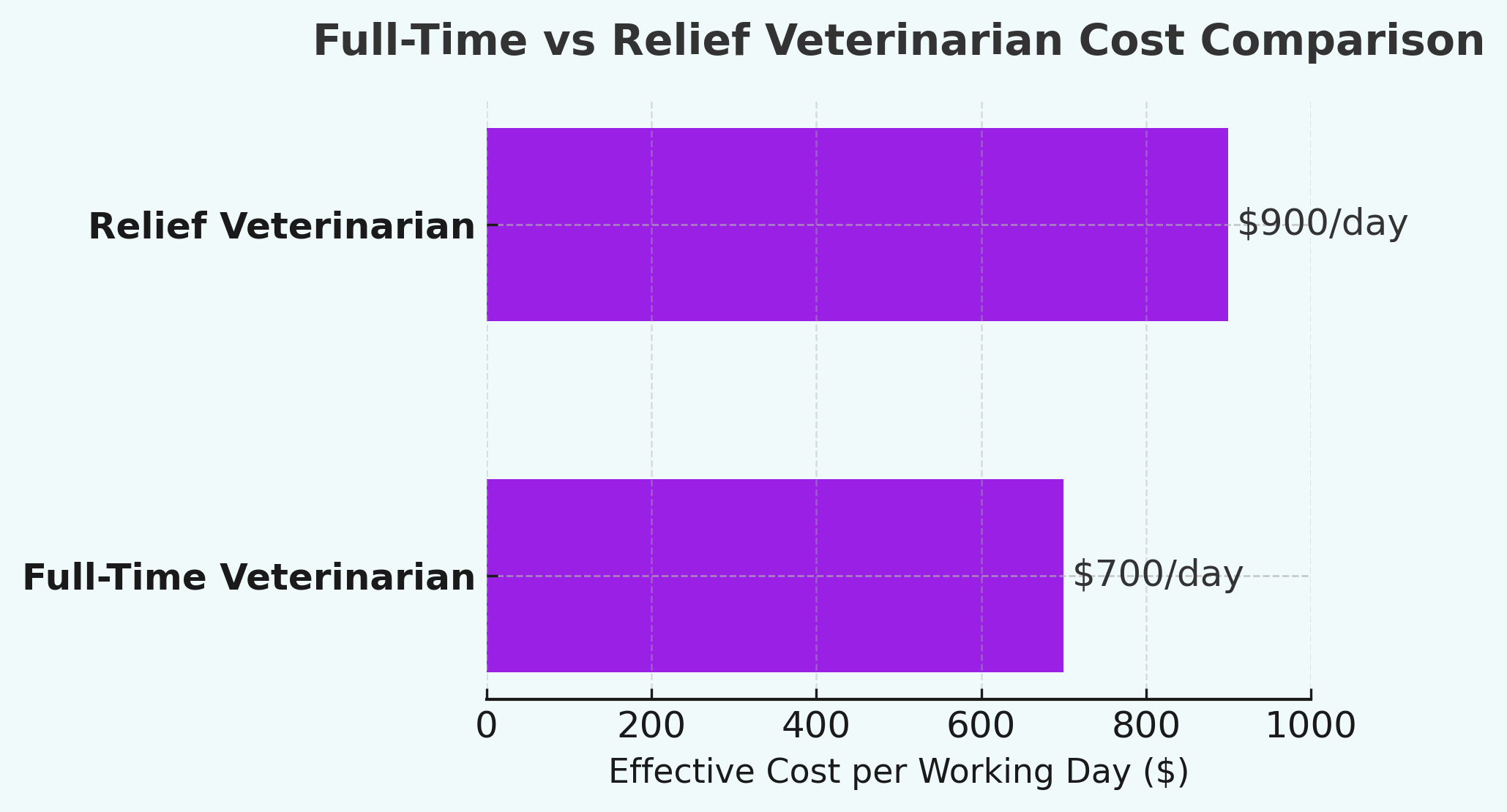

Relief vs Full-Time Veterinarian — The True ROI Comparison

Next, let’s put those numbers in context by comparing relief coverage to its closest alternative: hiring a full-time vet.

At first glance, paying a relief vet $800 a day can seem outrageous—especially if your associate’s daily pay breaks down closer to $450. But those numbers rarely tell the full story. Relief coverage and full-time employment solve different problems, and the real question isn’t “which is cheaper?” but “which is smarter for this situation?”

1. The All-In Cost of a Full-Time Veterinarian

Let’s take a $120,000/year vet. When you add benefits, payroll taxes, PTO, CE stipends, health insurance, and the occasional idle day when the schedule’s light, your true cost of employment easily tops $150,000–$160,000 per year.

Break that into days worked (~230 per year after holidays and vacation), and the effective cost per working day is about $650–$700—even before you account for recruiting and onboarding.

Now compare that to a relief vet who only steps in when there’s real demand: every dollar you spend directly translates to revenue-generating hours. No idle payroll. No benefits burn. No guilt about underutilization.

2. When Relief Coverage Wins

Relief work shines when coverage is unpredictable—maternity leave, sudden illness, peak season, or to prevent burnout.

It’s a flexibility premium: you pay a bit more per day, but only when you need it.

In many cases, that’s cheaper than carrying a full-time salary year-round.

3. When Full-Time Hiring Makes More Sense

If your schedule is consistently full and stable, a permanent hire is still the better investment.

Predictable caseloads make it easy to amortize the fixed costs of employment. You gain continuity, stronger client relationships, and less daily coordination.

But for practices operating on thin margins or with fluctuating demand, relief coverage often delivers a higher ROI per productive hour—even at a higher daily rate.

4. The Hybrid Reality

| Scenario / Factor | Relief Coverage | Full-Time Veterinarian | Hybrid Approach |

|---|---|---|---|

| Cost Efficiency | ✅ Best when demand fluctuates — pay only for productive hours. | ⚠️ Higher total cost due to benefits and idle time, but stable. | ✅ Balances cost by covering base demand with FTEs and using relief for peaks. |

| Schedule Stability | ❌ Not ideal for consistent, predictable workloads. | ✅ Ideal for steady, full caseloads. | ✅ Provides flexibility without full dependence on relief. |

| Flexibility & Coverage Gaps | ✅ Perfect for covering vacations, illness, or sudden surges. | ❌ Limited flexibility; needs backup plan. | ✅ Maintains coverage without overstaffing. |

| Team Continuity & Client Relationships | ⚠️ Vets rotate, so less continuity. | ✅ Strong client relationships, consistent care. | ✅ Core team provides continuity while relief supports gaps. |

| Administrative Overhead | ✅ Simple payroll (pay per shift), minimal HR overhead. | ❌ Requires benefits, recruiting, and onboarding. | ⚠️ Slightly more coordination but manageable. |

| Burnout Prevention | ✅ Offers breathing room for team; prevents overload. | ❌ Full-time staff may experience burnout if workload peaks. | ✅ Relief vets act as pressure release for staff. |

| Best For | Practices with variable caseloads, smaller teams, or seasonal fluctuations. | Large or consistently busy clinics with stable demand. | Medium-to-large practices balancing steady demand with occasional peaks. |

Many high-performing hospitals now blend the two models: a stable full-time core with relief coverage as a strategic buffer. It smooths out peaks, protects the team from burnout, and keeps service levels consistent.

Think of it as load balancing for your practice. Not a luxury, but a smart risk-management tool.

What Drives Relief Vet Rates Up (or Down)

If you’ve ever compared relief vet rates between two clinics—or even two weekends—you know they can feel unpredictable. But relief pricing isn’t chaos. It’s economics. Every rate tells a story about supply, demand, risk, and value.

Let’s decode the most important variables.

1. Region and Local Demand

Relief coverage follows market pressure, not state borders.

- High-demand urban zones (e.g., California, Texas, Ontario) tend to have dense networks of practices and a shortage of experienced relief vets. Result: upward pressure on rates.

- Smaller towns or rural areas might offer lower base rates but offset them with perks: travel reimbursement, lodging, or flexible scheduling.

A relief vet who travels three hours for a weekend shift isn’t just selling time, they’re selling availability.

2. Type of Work

Emergency and specialty coverage consistently outpaces GP rates. Overnight ER shifts can hit $2,500–$3,000 per day—and for good reason. Higher case intensity, emotional toll, and schedule disruption all add up.

On the other end, wellness-heavy GP clinics with structured appointments often command lower rates because predictability and workflow stability reduce friction.

3. Timing

The same vet might charge $1000 on a weekday and $1,300 on a holiday. Weekends, overnights, and short-notice requests always come at a premium.

It’s not greed—it’s opportunity cost. A vet who works a 12-hour Sunday forfeits time off, family time, or other bookings. The extra $100–$200 is the price of flexibility, not markup.

4. Experience and Skill Set

Relief vets with surgical confidence, ultrasound training, or multi-species experience can justify higher rates. The same goes for those with proven reliability or who handle high caseloads solo. In a field where reliability is priceless, reputation compounds faster than any platform algorithm.

5. Platform and Administrative Layers

Every intermediary takes a slice. Recruiters, staffing agencies, and some online marketplaces add 10–30% in overhead to cover admin, liability, and margins.

That’s why transparent marketplaces where vets set their own rates and clinics see total costs upfront are quietly reshaping the economics of relief work.

How to Budget for Relief Work Without Guesswork

Relief coverage doesn’t have to feel like rolling the dice. With the right systems, you can forecast costs with the same precision you use for inventory or payroll. The trick is shifting your mindset from “emergency spending” to strategic capacity planning.

Here’s how to take the guesswork out of the equation.

1. Start With Your Historical Data

Pull the last 12 months of relief usage. How many shifts did you book? Which seasons or months spiked?

If you know you needed 40 shifts last year and your average rate was $850, your annual relief budget baseline is already visible: $34,000.

Add a 10–15% buffer for growth or unexpected absences, and you’ve built your first predictive model.

Pro tip: Track patterns by department (GP, ER, surgery). You’ll often find that 80% of relief costs come from the same high-pressure zones.

2. Build a “Flex Coverage” Fund

Treat relief coverage as a fixed operating expense, not a panic purchase. Setting aside even 1–2% of annual revenue for temporary staffing creates breathing room when the unexpected happens.

This fund cushions cancellations, burnout, and maternity leaves without squeezing cash flow.

3. Set Rate Caps and Minimums

If you’re booking directly, establish an internal rate range for different shift types:

- GP weekday: up to $900

- Weekend/holiday: up to $1,100

- ER coverage: up to $1,400

This avoids ad hoc negotiations and gives you a quick “yes/no” filter. Over time, this consistency saves you mental energy—and money.

4. Automate Admin, Track ROI

Relief work gets expensive not just because of the rates, but because of the time it steals from your management bandwidth.

Use software or platforms that automate credentialing, payments, and reporting. If you can see who worked when, how much they produced, and what that cost per case looks like, you’ll make smarter, faster staffing decisions.

When you treat relief coverage like a line item with ROI, not a reactive expense, it transforms from a stress point into a strategic tool.

Where Serenity Vet Fits In

By now, one thing should be clear: the real problem isn’t the relief rate itself — it’s the uncertainty around it. When you don’t know what you’ll pay, how long it’ll take to fill a shift, or who’s showing up next week, the cost of staffing doubles in stress alone.

That’s exactly the problem Serenity Vet was built to solve.

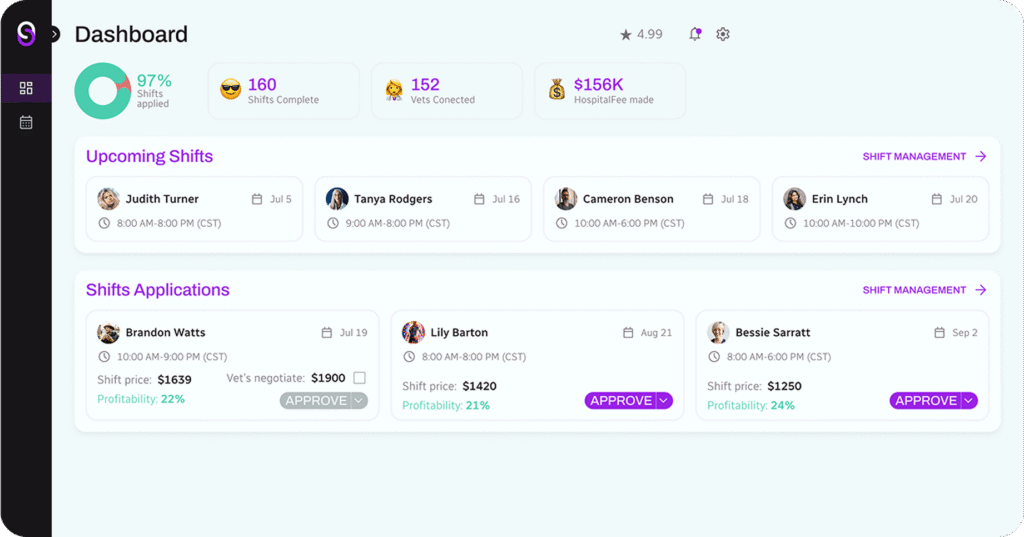

Transparent Rates, No Surprises

Serenity Vet connects clinics directly with relief veterinarians through clear, upfront pricing. Every vet sets their own rate, and you see the total amount you’ll pay before you book.

Centralized Scheduling and Payments

No more juggling spreadsheets, contracts, or endless email threads. Serenity Vet streamlines the entire process:

- View available relief vets by specialty, location, and rate.

- Book and confirm shifts instantly.

- Handle all payments automatically, with receipts ready for your accounting software.

Trust Built on Data

With every completed shift, you build a record — who worked, what they produced, and how that coverage performed. Over time, this gives you clarity on cost per shift, productivity per hour, and the true ROI of your staffing strategy.

Relief Work That Actually Feels Relieving

The difference isn’t just in the numbers; it’s in the predictability. Serenity Vet helps you move from reactive scheduling to proactive planning — protecting your bottom line, your team, and your sanity.

🩺 Start making relief coverage predictable.

Post your next shift on Serenity Vet and see how simple transparency can change the math — and the mindset — of staffing.