How to Budget and Plan for Relief Vets in 2026

Most veterinary practices don’t budget for relief vets. Then an associate takes unexpected medical leave, another starts interviewing elsewhere, and suddenly you’re paying premium rates for emergency coverage while appointment slots go unfilled. What starts as “we’ll figure it out when we need to” quickly becomes a five-figure unplanned expense that compounds into lost revenue, staff burnout, and clients who stop calling because they can’t get in.

Relief veterinarians have become essential infrastructure, similar to your inventory budget or facility costs. The question isn’t whether you’ll need relief coverage. It’s whether you’ll plan for it or get blindsided by it.

This article covers the benchmarks most practice owners wish they’d known earlier: what relief vets actually cost in 2026, how to forecast your real need without guessing, and the payment structure variables that determine whether you’re optimizing or overpaying.

By the end, you’ll have a budgeting framework you can use in your next planning meeting, built on real numbers instead of reactive spending.

Why Many Practices Get Relief Vet Budgeting Wrong

The biggest mistake we see clinics make when it comes to relief vets is treating them like emergency expenses instead of planned operational costs. You wouldn’t wait until your equipment breaks to budget for maintenance. But practices do this with staffing all the time, then understandably feel the strain when the bill comes.

Here’s where it typically falls apart:

It’s hard to remember that “full-time” doesn’t mean “always available. Your three associate DVMs aren’t actually working 52 weeks a year. They’re getting sick. They’re having kids, dealing with family emergencies, or taking necessary mental health breaks. Industry data suggests the average associate uses 15-25 PTO days annually, but when you’re building a budget six months out, it’s easy to default to perfect attendance assumptions.

The day rate feels more expensive than the alternative costs. A relief vet charging $850 for a Saturday shift is a line item you can see. What’s harder to quantify in the moment: that Saturday would’ve generated $3,200 in appointments, or that the client who couldn’t get in might not call back next time. The practices that hesitate on relief coverage because of visible costs often don’t realize they’re losing more money staying closed than they would’ve spent staying open.

Sometimes you optimize for the wrong number. Shopping for the lowest rate makes sense until you factor in booking fees, onboarding time with a rotating cast of strangers, and the quality variance that comes with whoever’s available on short notice. The sticker price rarely tells the whole story.

💡 Good practice managers think about relief vets the same way they think about business interruption insurance. You’re not buying labor hours. You’re buying continuity, revenue protection, and the ability to run your practice even when life happens to your team.

What Relief Vets Actually Cost in 2026

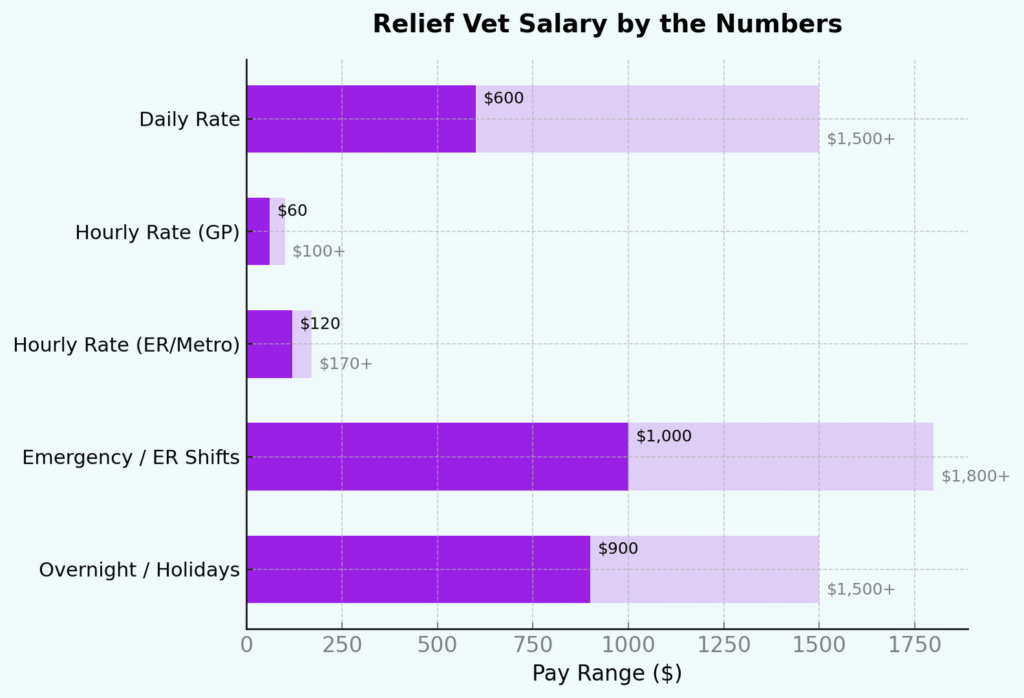

Let’s start with the number everyone wants to know: day rates typically range from $600 to $1,500+, depending on where you are and what you need. A general practice relief vet in rural Iowa might charge $650 for a weekday. That same vet working a Saturday in metropolitan Seattle could command $1,300. Throw in emergency work or specialized skills, and rates climb further.

Geography drives a lot of this variation, but so does urgency. Book a relief vet three weeks out and you’ll pay standard rates. Need someone for tomorrow because your associate just called out sick? Expect a premium sometimes 20-30% above the normal rate. Weekend and holiday multipliers are standard, and they add up faster than you’d think.

💡 For a more detailed breakdown of how these rates are structured regionally, what drives specialty premiums, and which hidden fees show up on invoices, see our complete guide: How Much Do Relief Vets Cost?

Here are the benchmarks worth knowing when you’re building your 2026 budget:

Relief days per full-time DVM: Industry averages land around 15-25 relief days per year per associate. That’s covering PTO, sick days, and the occasional gap between hires. Practices that budget for fewer than 15 days per DVM tend to scramble. Practices that plan for 25+ are usually being realistic about turnover and burnout prevention.

Cost per appointment covered: If you’re paying $800 for a relief vet who sees 15 appointments, you’re spending roughly $55 per appointment to keep revenue flowing. Compare that to the $150-$400 each of those appointments generates, and the ROI becomes obvious.

Now for the costs that don’t show up in the day rate quote:

Per-shift booking fees: Traditional relief platforms often charge 20-40% of the day rate as a transaction fee. That $800 day suddenly costs $960-$1,120 once the platform takes its cut. Do that twice a month and you’re adding $3,840-$7,680 annually just in fees.

Onboarding and coordination time: Every new relief vet needs a walkthrough of your software, your protocols, where things are. If you’re rotating through different relief vets regularly, your office manager is spending hours each month on logistics that don’t happen with a consistent roster.

Quality inconsistency risk: Not all relief vets are created equal, and when you’re booking through last-minute availability, you get who you get. The cost of a relief vet who miscommunicates with clients, misses documentation, or creates extra follow-up work doesn’t appear on any invoice—but it shows up in your team’s stress levels and sometimes in your online reviews.

The practices that budget most effectively don’t just look at the day rate.

They calculate total cost of ownership: rate + fees + time + risk. That’s the real number.

The Hidden ROI: What You’re Really Buying

The budget conversation usually stops at “how much will this cost?” But the better question is what happens if you don’t spend it.

Start with the most obvious number: revenue protection. A typical DVM sees 15 appointments per day and generates approximately $3,000-$6,000 in daily revenue. Close the practice for one day because you don’t have coverage, and you’re walking away from $3,000-$6,000 in revenue. Do that twice a month and you’ve lost $72,000-$144,000 annually — far more than you would’ve spent on reliable relief coverage.

And that’s just the immediate revenue. The client who can’t get an appointment this week might go somewhere else next week. Client acquisition costs in veterinary medicine run $40-$150 per new client when you factor in marketing spend. Losing established clients because you couldn’t see them is expensive in ways that don’t show up on a single day’s P&L.

Then there’s the retention multiplier. Burned-out DVMs leave.

Industry estimates put the cost of replacing an associate veterinarian at $100,000-$250,000 or more once you account for recruiting, onboarding, lost productivity during the ramp-up period, and the mistakes that happen when someone’s learning your systems. Relief coverage that gives your full-time team actual time off isn’t just a nice gesture — it’s a retention strategy with a measurable return.

Practices that run their DVMs into the ground lose them. Practices that build in breathing room keep them. The difference in your talent costs over five years is substantial.

There’s also a less obvious factor that matters if you’re ever planning to sell: practice valuation. Buyers pay premiums for practices with operational resilience and low key-person risk. If your revenue depends entirely on one or two DVMs who never take time off, you’re building a fragile business. Demonstrate that you have systems for consistent coverage and predictable operations, and you’re building a more valuable asset.

The compounding effect of all this is that good relief vet planning doesn’t just prevent disasters, it enables growth. You can confidently add appointment capacity knowing you can cover it. You can recruit better associates by honestly promising reasonable schedules. You can say yes to opportunities instead of turning them down because you’re already stretched too thin.

Relief vet spending isn’t overhead. It’s infrastructure that protects revenue, preserves talent, and makes your practice more valuable. The ROI isn’t hidden, it’s just measured in things other than the day rate.

Platform Economics: Subscription vs. Per-Shift Models

Once you know what you need to spend, the next decision is how you structure that spending. The payment model you choose changes your total cost, your administrative overhead, and how much flexibility you actually have when you need coverage.

The traditional per-shift model works like this: you pay the relief vet’s day rate, then the platform takes a booking fee (typically 20-40% of that rate). If you’re booking occasionally, a few times per quarter, those transaction fees feel manageable. But once you’re using relief coverage consistently—say, twice a month—you’re paying $3,840 to $7,080 annually just in platform fees before you’ve paid a single day rate.

The math gets worse when you need coverage urgently. Many per-shift platforms prioritize their highest-volume customers or charge premiums for last-minute requests, which means you’re either paying more or waiting longer exactly when you need help most.

The subscription model flips the economics. You pay a fixed monthly fee based on how many relief vets you’re managing, not how many shifts you book. Serenity Vet (hey 👋) operates on this model, charging based on your relief vet roster size rather than per-shift transaction fees. That means no surprise charges when you need coverage, no percentage taken from each booking, and no penalty for using the platform more frequently.

For the practice using 71 relief days per year (roughly 6 per month), the difference is significant. Under a per-shift model with 20% fees, you’re paying an extra $10,650 annually. Under a subscription model, that money stays in your budget.

There are secondary factors worth considering too. Per-shift platforms often mean you’re working with whoever’s available that day: different vets, different communication styles, different familiarity with your systems. Subscription models typically give you more control over building a consistent roster of relief vets who know your practice, which reduces onboarding time and improves quality.

The administrative load is different as well. Booking fees mean invoices to reconcile, variable costs to track, and budget surprises when you need more coverage than expected. Fixed subscription costs are predictable, easier to forecast, and require less ongoing financial management.

The break-even point comes down to frequency. If you’re genuinely only using relief coverage 2-3 times per year, per-shift fees might make sense despite the transaction costs. But if you’re using relief vets monthly (and most practices are once they start planning properly) subscription economics tend to win.

Make 2026 the Year Relief Becomes Strategic

The practices that budget for relief vets outperform the ones that don’t. Not because they spend more, often they spend less, because they’re not paying urgency premiums or dealing with last-minute bookings. They outperform because they’ve turned an unpredictable cost into a managed one, and because their teams aren’t burning out from coverage gaps.

Here’s your next step: pull your 2025 relief spending. Run it through the framework we offered. Calculate your realistic 2026 need, stress-test it against best and worst-case scenarios, and then compare the economics of per-shift versus subscription models based on your actual usage patterns.

The mindset shift matters as much as the math. Relief vets aren’t a sign that your staffing model is broken. They’re a competitive advantage. They let you protect revenue when life happens to your team. They let you grow without over-hiring. They let you recruit and retain better associates by promising schedules that are actually sustainable.

The best time to build a relief vet budget was last year. The second-best time is right now.

Find Relief Vets on Your Terms

Set the rate, pick the vet, and keep your clinic running at full speed.